In the fast-paced world of trucking, maintaining a healthy cash flow is crucial for the success and growth of freight carriers. However, the nature of the industry often leads to delayed payments from shippers and brokers, which can put a strain on a trucking company’s finances. Freight factoring has emerged as a powerful financial tool to address this issue. In this comprehensive guide, we’ll delve into the intricacies of freight factoring, explaining what it is, how it works, and why it has become a lifeline for trucking businesses worldwide.

What is Freight Factoring?

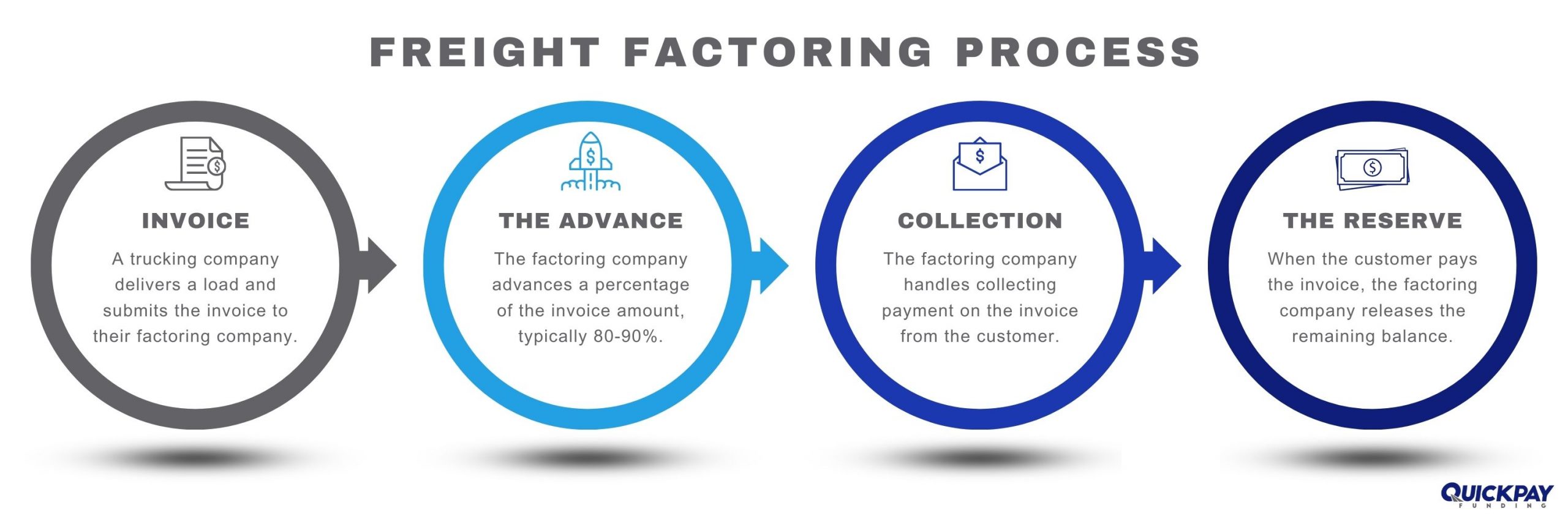

Freight factoring, also known as trucking factoring, is a type of financing that allows transportation companies to get paid immediately for their freight invoices. The factoring company advances a percentage of the invoice amount to the transportation company, and then collects the full amount from the customer when the invoice is due. It allows trucking companies to convert their accounts receivable into immediate cash by selling their outstanding invoices to a factoring company. In essence, freight factoring helps businesses bridge the gap between invoice creation and customer payment, enabling them to access much-needed working capital without waiting for lengthy payment terms.

How Freight Factoring Works

- Initial setup: To get started with freight factoring, a trucking company partners with a reputable factoring company. This involves signing an agreement that outlines the terms and conditions of the arrangement.

- Delivery of service: Once the agreement is in place, the trucking company transports goods for its clients as usual. Upon completion of a job, the company generates an invoice for the services rendered.

- Invoice submission: Instead of waiting for the customer to pay, the trucking company submits the invoice to the factoring company. The factoring company verifies the legitimacy of the invoice and the creditworthiness of the customer.

- Advance and reserve: After verification, the factoring company advances a significant percentage of the invoice value, typically around 80% to 90%, to the trucking company. This advance serves as immediate working capital, enabling the company to cover expenses like fuel, maintenance, and payroll.

- Remaining Balance Settlement: The factoring company assumes the responsibility of collecting payment from the customer. Once the customer pays the invoice in full, the factoring company deducts its fee, which typically ranges from 1-5% of the total invoice amount, and releases the remaining balance to the trucking company.

Benefits of Freight Factoring:

- Improved cash flow: By converting accounts receivable into immediate cash, freight factoring provides trucking companies with a reliable and consistent cash flow. This financial stability allows businesses to meet their operational expenses promptly, invest in growth opportunities, and avoid cash flow gaps that may hinder day-to-day operations.

- Reduced administrative burden: Freight factoring eliminates the need for trucking companies to manage collections, invoicing, and credit checks. The factoring company handles these tasks, freeing up valuable time and resources for the business to focus on core operations.

- Flexible funding: Freight factoring provides flexible funding that grows with the business. As the trucking company takes on more clients and generates more invoices, the factoring line can be adjusted to accommodate increased funding needs. Additionally, companies don’t have to factor all their invoices. Many companies only factor the invoices they need to cover short-term expenses.

- Accessible financing: Freight factoring is relatively easier to obtain compared to traditional bank loans (Factoring vs. Bank Loans). Factoring companies primarily consider the creditworthiness of the customer rather than the trucking company’s credit history. This makes it an attractive option for businesses with limited credit or a short operating history.

Additional Services Offered by Quickpay Funding

At Quickpay Funding, we provide a range of services to further assist trucking companies in managing their finances and operations. Here’s a few of the services our clients love:

- 24/7 Fuel Advances: We process fuel advances around the clock, including weekends and holidays. This ensures our clients can get the funds they need when they need it, even outside of regular business hours. Getting cash before delivery helps keep their trucks fueled and on the road without delays or disruptions.

- Free and Unlimited Credit Checks: We perform comprehensive credit checks and warn our clients of any risk when taking a load from a potential customer or broker that has a history of bad payments or questionable credit. By assessing the creditworthiness of these entities, our clients can make informed decisions about the loads they choose to haul. This service helps mitigate the risk of non-payment or delayed payments.

- Carrier Packet Setup: We fill out all the carrier packets and MSA’s for all our clients AT NO EXTRA CHARGE. Other factoring companies charge a weekly or monthly fee to do this or charge $25 for each carrier packet.

Conclusion

Freight factoring serves as a lifeline for trucking companies. It helps them navigate the challenges of cash flow management and maintain financial stability. By converting invoices into immediate cash, freight factoring ensures that trucking businesses have the necessary funds to sustain operations, seize growth opportunities, and thrive in a competitive industry. Understanding the ins and outs of freight factoring can empower trucking companies to make informed financial decisions that align with their business goals. If you’re a trucking company seeking financial stability, freight factoring might just be the solution you’ve been looking for.