Freight Broker Factoring

Grow Your Freight Brokerage with Consistent Cash Flow

Attract more carriers and streamline your operations with hassle-free freight broker factoring from Quickpay.

Factoring for Freight Brokers

Are you trying to grow your freight brokerage but slow paying shippers are holding you back? Freight broker factoring provides you with immediate access to working capital so you can pay carriers fast and boost your credibility. Our industry-leading financial solutions help you improve cash flow, book more loads, and build strong carrier relationships.

Get Paid Faster

Instead of waiting 30 to 90 days, you’ll get paid the same-day you submit an invoice.

Quick Pay Carriers

Attract and retain more carriers with 24/7 same-day Quick Pay options.

Grow Your Brokerage

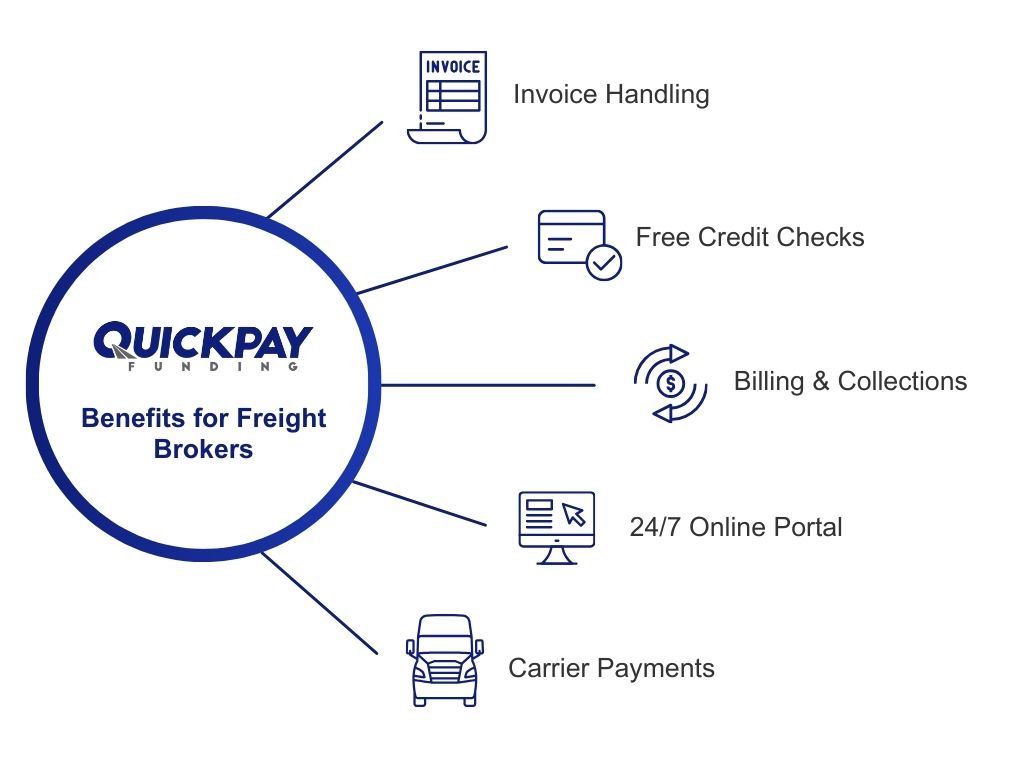

We handle billing and collecting while you stay focused on growing your business.

24/7 Broker Factoring

We fund your broker account 24/7/365, including weekends and even on bank holidays.

Apply for Broker Factoring Today!

Our application takes approximately 5 minutes to complete once registered.

Why Freight Brokers Choose Quickpay Funding

Full Advances

Full advance programs allow you to access your margins immediately.

Free TMS

Free access to AscendTMS, the best transportation management system available, for a full year for qualifying clients.

Fuel Advances

Send your carriers cash before delivery and avoid delays with 24/7 fuel advances.

No Cutoff Times

There’s no cutoff time when you fund with Real-Time Payments. When we say we’re open to fund our clients 24/7, we really mean it.

Free Credit Checks

Free and unlimited credit checks on all of your customers so you can book loads with confidence.

Credit Bureau Reporting

We report monthly to credit bureaus to improve the credit score of our broker clients.

…and more!

How Freight Broker Factoring Works

Freight broker factoring works by selling your unpaid freight invoices to a broker factoring company, like Quickpay Funding, in exchange for immediate cash. This allows you to pay carriers quickly and have increased working capital to ensure smooth business operations. This unique form of freight factoring is specifically designed to cater to the distinct requirements of freight brokers. Quickpay Funding makes factoring simple for brokers so they can promptly pay carriers and bolster their working capital.

1

Your load is delivered.

2

Send us your paperwork.

3

Get paid the same day.

Ready?

Partner with Factoring Experts Who Understand Your Business

We have strong relationships with freight brokers of all sizes, from small startups to seasoned enterprises, and we provide them with the financial support they need to operate smoothly and seize new opportunities. Freight brokers start factoring with Quickpay Funding because we understand their unique needs and challenges, but they stay with us because we consistently deliver the financial solutions and support the need to thrive. Our clients book more loads, attract more carriers, and grow their business faster.

Empowering Freight Brokers

Ready to take your freight brokerage to new heights? Factoring can be the catalyst for your success, providing the working capital you need to book more loads, seize growth opportunities, optimize cash flow, and propel your business to the next level.

Keep focused on growing your business.

Don’t let a lack of working capital keep your freight brokerage from reaching its full potential. We’ll make sure you get the cash flow needed to keep you focused on what you do best – running your business.

Attract more carriers to your brokerage.

Ensure your carriers are paid quickly and dependably with our 24/7 Quick Pay options. You’ll build a strong reputation and credit rating that will allow you to dispatch more loads and maximize efficiency.

Quickpay Portal

Manage your broker factoring account anywhere, anytime. The Quickpay Portal is a secure, personalized, and responsive platform that gives you control over virtually ever aspect of your business.

- Quickly and easily upload invoices

- Sumbit credit requests

- Search existing invoices, payments, transactions, and debtors

- View the latest account information at a glance on the Dashboard

- Add debtors, request credit and disbursements, and much more.

Grow Your Freight Brokerage Faster with Quickpay!

Apply for Freight Broker Factoring today and get the working capital you need to expand your business and seize new opportunities.

Freight Broker Factoring FAQs

What is freight broker factoring?

Freight broker factoring is a type of financing that allows freight brokers to get paid immediately for their open invoices. It is a form of freight factoring, but it’s tailored to the specific needs of freight brokers. The factoring company advances a percentage of the invoice amount to the broker, and then collects the full amount from the customer when the invoice is due.

How do freight brokers benefit from factoring?

Freight brokers can benefit from factoring in several ways, undoubtedly making it a valuable financial tool for their business operations. Here are the key benefits that freight brokers can enjoy from factoring:

Improved Cash Flow

One of the primary benefits of freight broker factoring is the immediate boost to cash flow. Factoring provides an upfront cash advance on invoices, allowing brokers to access funds quickly. This enables them to cover essential expenses, pay carriers quickly, and invest in growth opportunities without waiting for clients to pay.

Competitive Advantage

With factoring you’ll be able to consistently pay carriers fast and boost your reputation in the industry. As a result, it will be much easier to attract and retain quality carriers. This can lead to better service and more business opportunities.

Reduced Administrative Burden

Factoring companies often handle accounts receivable management and collections, which means brokers can save time and resources that would otherwise be spent on chasing payments. This allows you to focus more on core business activities, such as securing new clients and managing shipments.

Credit Protection

Factoring companies typically assess the creditworthiness of the broker’s clients (shippers) before approving invoices for factoring. This can help protect brokers from working with clients who have a history of late or non-payment.

Flexibility

Factoring arrangements are flexible and can be tailored to the specific needs of the freight broker. For instance, freight brokers can choose which invoices to factor, and they are not obligated to factor all invoices. This flexibility allows them to manage their cash flow strategically.

No Debt Incurred

Factoring is not a loan, so it doesn’t add debt to your balance sheet. Instead, it’s a form of financing based on the sale of accounts receivable, making it a favorable option for those who want to avoid traditional loans.

Scalability

Factoring is scalable and can grow with the broker’s business. As the broker takes on more clients and generates more invoices, they can increase the volume of factored invoices to meet their evolving financing needs.

Risk Mitigation

Factoring companies often assume some of the credit risk associated with the broker’s clients. In the event of client non-payment, the factoring company may have recourse against the client, reducing the broker’s exposure to bad debt.

Access to Expertise

Many factoring companies, like Quickpay Funding, specialize in the transportation and logistics industry. This means they have expertise in dealing with the unique challenges and payment dynamics of this sector. Freight brokers can benefit from this industry-specific knowledge.

What services will I be able to offer my carriers?

With Quickpay Funding as your factoring company, you’ll be able to offer your carriers 24/7 fuel advances, same-day QuickPays, unlimited credit checks and more!

How do freight brokers get started with Quickpay?

Getting started is easy!

1. Contact us: Give us a call or fill out our online form → Apply Online in Minutes!

2. Get a free quote: We’ll provide a no-obligation quote based on your needs.

3. Submit your invoices: Start factoring and get paid faster!

Still have questions? We’re here to help! Contact our team of freight broker factoring experts to discuss your specific needs and find the best solution for your freight brokerage.