If you run a small or medium-sized business, maintaining steady cash flow is critical to your success. But what happens when those outstanding invoices start piling up? The solution lies in unlocking the cash trapped in your unpaid invoices, and that’s where invoice factoring and invoice financing come into play. While both options can provide quick access to working capital, they have distinct differences that are important to understand.

What Is Invoice Factoring?

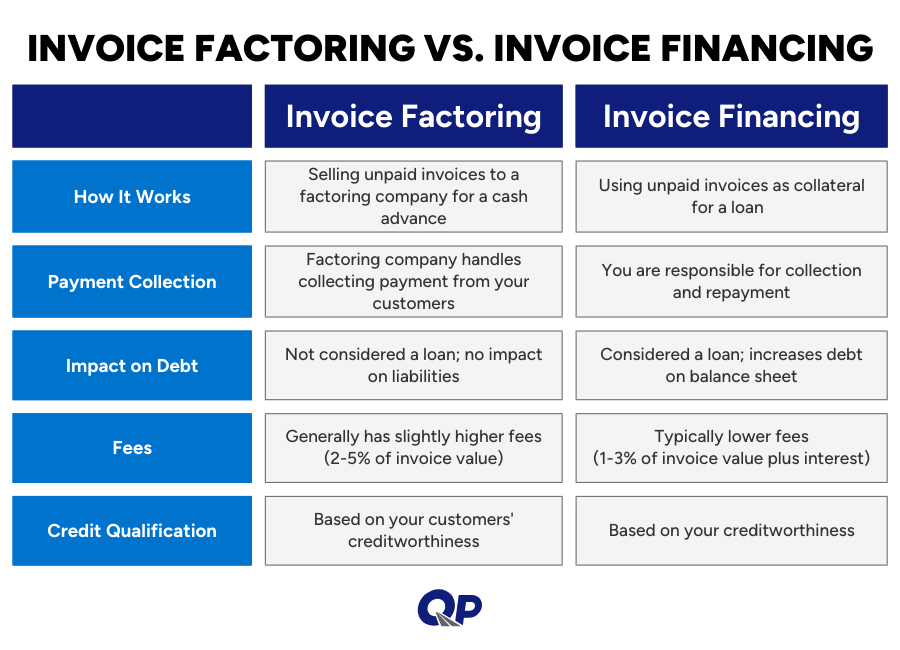

Invoice factoring involves selling your unpaid invoices to a factoring company in exchange for a cash advance on those invoices. The factoring company advances you a percentage of the invoice value, typically 80-90%, within 24-48 hours. They then take on the responsibility of collecting payment from your customers. Once your customer pays the invoice, you receive the remaining balance minus the factoring fee.

Key Benefits of Invoice Factoring:

- Quick access to cash: Funds are often available within 24-48 hours, providing immediate working capital.

- Improved cash flow: Convert unpaid invoices into immediate cash, allowing you to meet financial needs such as payroll, inventory purchases, or unexpected expenses.

- Easier qualification: Factoring decisions are based on your customers’ creditworthiness, not yours, making it accessible for businesses with limited credit history.

- Reduced administrative burden: The factoring company handles collections, freeing up your time to focus on core business activities.

- No debt incurred: Unlike traditional loans, factoring does not involve taking on additional debt.

What Is Invoice Financing?

Invoice financing, sometimes called accounts receivable financing, allows businesses to use their unpaid invoices as collateral for a loan. Unlike invoice factoring, you maintain ownership of the invoices and are responsible for collecting payment from your customers. The financing company provides you with a cash advance against the value of the invoice, which you repay with interest once the invoice is settled.

Key Benefits of Invoice Financing:

- Quick Access to Cash: Like factoring, invoice financing provides you with an immediate advance on your invoices, helping to boost your working capital.

- Improved Cash Flow: By converting unpaid invoices into cash, invoice financing helps maintain the liquidity you need for day-to-day operations.

- Maintain control of customer relationships: You continue to manage your own collections process.

Invoice Factoring vs. Invoice Financing: Which is Right for Your Business?

Choosing between invoice factoring and invoice financing depends on your specific business needs and circumstances. Both offer the ultimate solution of getting paid for your invoices quickly, but the way each method operates is different. Invoice factoring involves selling your invoices, while invoice financing is securing a loan using your invoices as collateral.