If you’re considering invoice factoring as a financing solution for your business, you’ll likely encounter some unfamiliar terminology. Understanding these terms will help you choose the right factoring company for your business. By being familiar with the key concepts, you can ask informed questions, assess different factoring options more effectively, and ensure that the terms align with your business needs. In this blog post, we’ll break down six essential invoice factoring terms that will enhance your understanding and help you communicate effectively with your factoring partner.

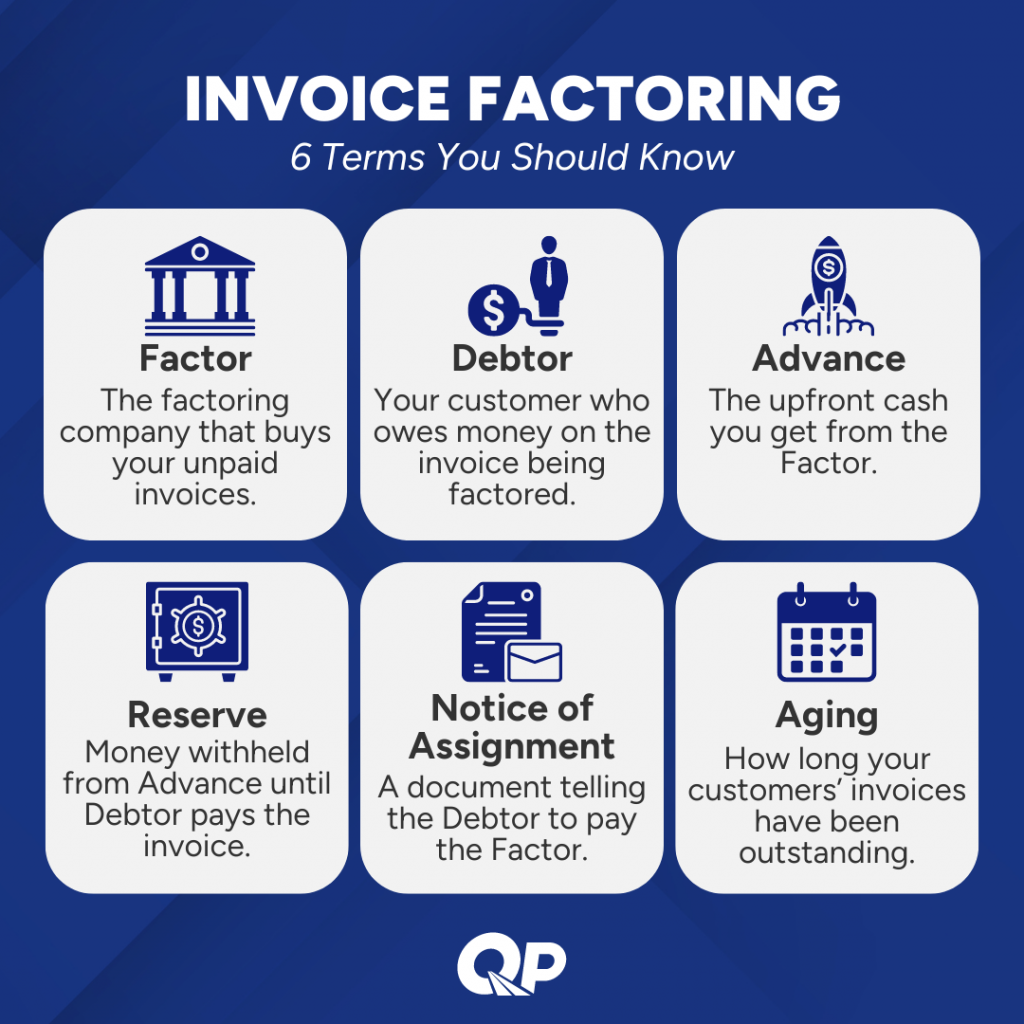

1. Factor

In the context of invoice factoring, the Factor refers to the company that buys your unpaid invoices. When you sell invoices to a factor, you’re exchanging them for immediate cash, rather than waiting for your customers to pay. The factor assumes the responsibility of collecting payment from your customers (debtors). Essentially, they provide you with upfront funds based on the value of your receivables and take on the task of collecting payment.

Factors are especially beneficial for businesses with long payment cycles, like those in trucking, produce, or other industries where waiting for 30, 60, or even 90 days for payment can create cash flow challenges.

2. Debtor

A Debtor is your customer—the person or business that owes money for the product or service you’ve provided. In the factoring process, your debtor is the entity responsible for paying the invoice that you’ve sold to the factoring company. When you factor an invoice, you’re essentially transferring the right to collect payment from the debtor to the factoring company. Once the factor purchases your invoice, they will collect payment directly from the debtor.

It’s important to work with reliable debtors because their creditworthiness and payment reliability can impact your relationship with the factoring company. Many factors perform credit checks on debtors to assess the risk before purchasing invoices, helping you avoid working with customers who may not pay on time.

3. Advance

The Advance is the initial payment you receive from the factor when you sell your invoice. Typically, this ranges from 70% to 90% of the invoice value, depending on various factors such as your industry, the creditworthiness of your debtors, and the factor’s policies.

For example, if you factor a $10,000 invoice with an 85% advance rate, you will receive $8,500 immediately from the factor. The remaining 15% is held in a reserve and paid to you, minus the factoring fee, once the debtor pays the invoice in full.

4. Reserve

The Reserve is the portion of the invoice amount that the factor holds back until the debtor fully pays the invoice. This reserve acts as a safeguard for the factoring company to cover any unexpected issues, such as invoice disputes or payment delays.

Once the debtor pays the invoice in full, the factor releases the reserve to you, minus any applicable fees. Using the previous example, if you received an advance of $8,500 on a $10,000 invoice, the reserve would be $1,500. After the debtor pays, the factor will return this $1,500 to you, minus any factoring fees.

5. Notice of Assignment (NOA)

A Notice of Assignment (NOA) is a formal document sent by the factoring company to your customers (debtors), informing them that the invoice has been factored and that payment should now be made directly to the factoring company.

The NOA streamlines the payment process for the factor and ensures that all payments related to the factored invoices are made to them. It’s important that your debtors understand this process to avoid confusion and delays in payments, as failing to comply with the NOA could result in payment issues.

6. Aging

Aging refers to how long your customers’ invoices have been outstanding. It’s tracked in an Aging Report, a document that lists all outstanding invoices and categorizes them based on how long they’ve been outstanding. This report is a critical tool in the factoring process, used by both you and the factor to manage accounts receivable. Typical categories in an aging report include:

- 1-30 days

- 31-60 days

- 61-90 days

- Over 90 days

The aging report is important because:

- It helps identify slow-paying customers

- Factors use it to assess the overall health of your accounts receivable

- It can affect your factoring rates and terms

- It’s a valuable tool for managing your cash flow and customer relationships

Regularly reviewing your aging report can help you spot payment trends and address issues before they become significant problems.

Let’s recap:

- Factor: The financial institution providing factoring services.

- Debtor: Your customer who owes you payment.

- Advance: The upfront payment you receive from the factor.

- Reserve: The portion held back until the invoice is paid.

- Notice of Assignment: Notification sent to your customers about the factoring arrangement.

- Aging: How long your customers’ invoices have been outstanding.

Understanding these six key terms will provide you with a solid foundation in the language of invoice factoring. As you explore factoring as a potential solution for your business, don’t hesitate to ask your factor to clarify any terms or concepts that you are unsure about. Remember, knowledge is power, and a clear understanding of the factoring process will help you make informed decisions that benefit your business.

Invoice factoring can be a powerful tool for improving your cash flow and fueling business growth. By partnering with a reputable factor and familiarizing yourself with the key terminology, you can leverage this financial solution to achieve your goals and overcome cash flow challenges.