Invoice Factoring: What It Is and How It Works

Learn how invoice factoring works, find the best invoice factoring company, and start getting paid faster.

Table of contents

What is invoice factoring?

What is a factoring company?

Why choose invoice factoring?

How does invoice factoring work?

When to use invoice factoring

Advantages of factoring

Disadvantages of factoring

What industries use invoice factoring?

Choosing the best factoring company

What is Invoice Factoring?

Invoice factoring is a way to get an advance on your invoices. Instead of waiting weeks or months for customers to pay, you sell your invoices to a factoring company. They pay you immediately (minus a small fee), and then they collect the full payment from your customer later. This improves your cash flow and ensures inconsistent customer payments won’t hurt your business.

What is a Factoring Company?

A factoring company is a financial institution that buys another company’s unpaid invoices. They pay the seller a large portion of the invoice value right away, and then collect the full payment from the customer later. The factoring company makes money by charging a small fee for each invoice. This way, the seller can get cash faster and solve their cash flow problems. A factoring company is like a financial middleman. They’ll buy your outstanding invoices at a discount, giving you immediate access to cash. So, instead of waiting for your customer to pay, you can use that cash to fund your business operations, pay your employees, or invest in growth.

Why Use Invoice Factoring?

Faster access to cash

No more waiting 30, 60, or even 90 days for customer payments. Get funded within days to cover expenses, payroll, or investments.

No debt incurred

Unlike loans, factoring does not involve taking on debt. It’s financing based on outstanding invoices, making it a suitable option for companies looking to avoid additional financial liabilities.

Consistent cash flow

Predictable cash flow allows you to take on bigger contracts with confidence, cover payroll and operational costs with ease, and scale your business.

Build credit

Factoring can strengthen your financial profile, making it easier to secure other financing.

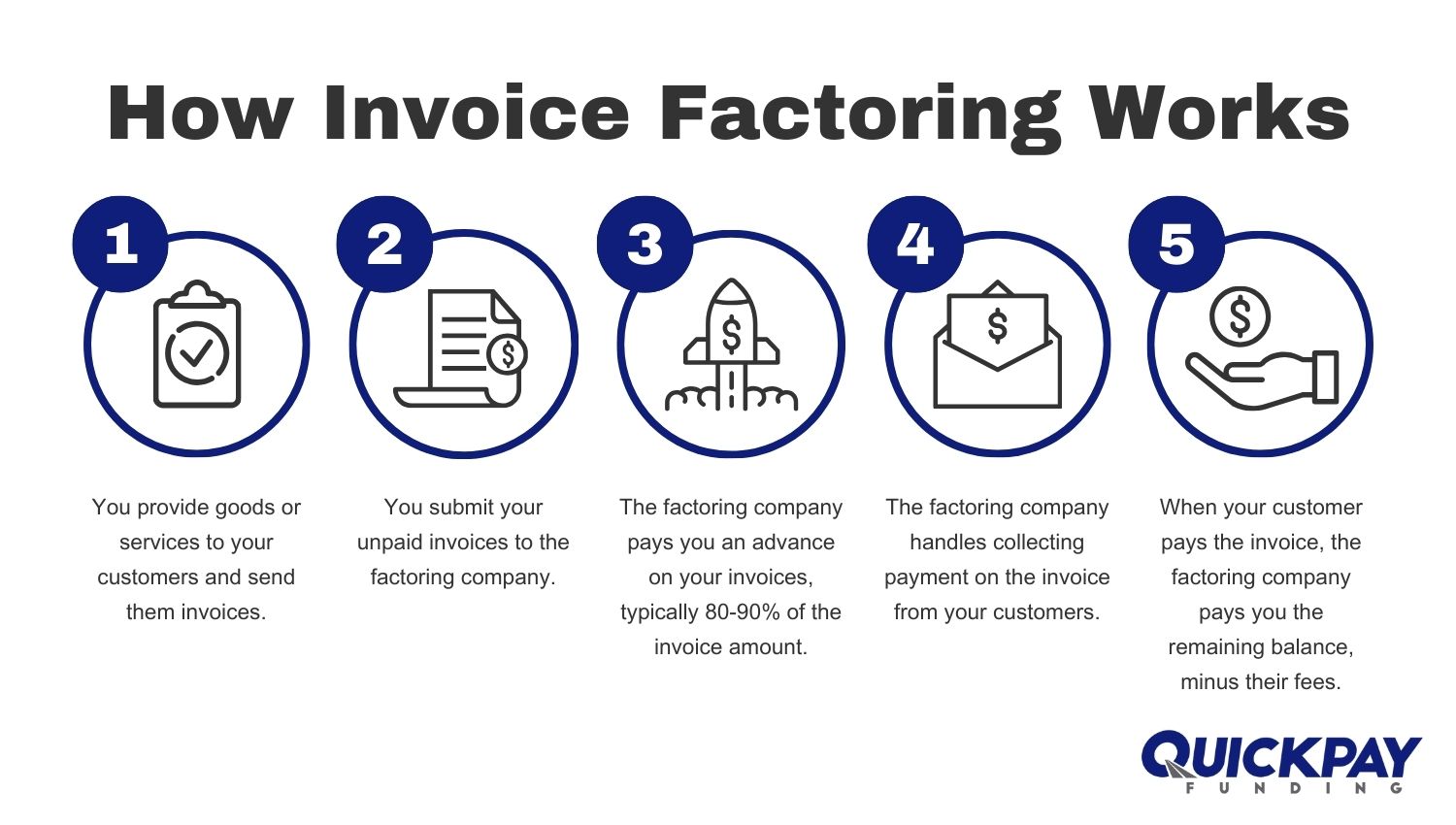

How Does Invoice Factoring Work?

Invoice factoring converts your outstanding invoices into immediate cash, boosting your business’s working capital. Here’s how it works in a 5-step process:

1. Complete the Job

Provide your goods or services as usual. Then, create and send an invoice to your customer.

2. Submit Invoice to Factor

Send the invoice to your invoice factoring company.

3. Receive Your Advance

Get a significant portion of the invoice’s value (usually 80-90%) often within 24 hours..

4. Factor Collects Payment

The factoring company communicates with your customer and handles the entire collection process.

5. Receive Remaining Balance

Once the customer pays in full, the invoice factoring company deducts their fee and sends you the rest.

Invoice Factoring Example:

You are a small business owner who provides landscaping services to commercial clients. You have just completed a job for a new client and have sent them an invoice for $10,000. However, you know that it will take them 30 to 60 days to pay you.

Instead of waiting for your client to pay the invoice, you decide to use a factoring company like Quickpay Funding. The factoring company agrees to buy your invoices and advance you 90% of the total invoice amount for a 2% factoring fee.

You submit the invoice to your factoring company, and they advance you 90% of the invoice, or $9,000, the same day. This immediate injection of cash helps you cover operating expenses, pay employees, and invest in new projects without waiting for client payments.

The factoring company then handles collecting payment directly from your client. 30 to 60 days later, your client pays the invoice. The factoring company then deducts their 2% factoring fee, or $200, and pays you the remaining 8%, or $800.

When to Use Invoice Factoring

Invoice factoring is a smart financial solution for businesses facing cash flow challenges. Here’s when it makes the most sense:

Managing Seasonal Fluctuations

If your business experiences slow seasons, factoring can ensure consistent cash flow to cover expenses and maintain operations.

Fueling Rapid Growth

When your business is expanding quickly, factoring provides the working capital you need to seize new opportunities without waiting for customer payments.

Startups Needing Cash Flow

New businesses often lack the credit history for traditional loans. Factoring gives you access to funds based on your customers’ creditworthiness.

Dealing with Slow-Paying Customers

If long payment cycles strain your cash flow, factoring eliminates those delays, providing financial stability.

Overcoming Credit Limitations

Factoring companies primarily focus on your customers’ creditworthiness, making it a viable option even if your business credit isn’t perfect.

Advantages and Disadvantages of Invoice Factoring

Advantages

Improved cash flow

Factoring provides immediate cash flow, which helps businesses meet their short-term financial needs, pay bills, invest in growth, and seize new opportunities.

No debt incurred

Unlike traditional loans, factoring does not involve taking on additional debt.

Flexible financing

Factoring is scalable, meaning you can factor as many or as few invoices as needed, depending on your cash flow requirements. This flexibility can be especially valuable for seasonal businesses.

Easier to qualify

Factoring is typically easier to qualify for than traditional loans, such as bank loans. This is because factors focus on the creditworthiness of the business’s customers, rather than the business itself.

Reduced administration burden

Factoring companies take on the task of collecting payments from your clients, saving you time and resources that can be allocated to other aspects of your business.

Disadvantages

Cost

Factoring comes at a cost, as you’re essentially selling your invoices at a discount (the factoring fee).

Potential for hidden fees

Not all factoring companies are transparent with their fee structure. When choosing a factoring company be sure to carefully review and understand the terms of the agreement.

Industries that use Invoice Factoring

Invoice factoring is used by a wide variety of industries, but it is most commonly used by small and medium-sized businesses (SMBs). SMBs often have difficulty qualifying for traditional bank loans and lines of credit, and invoice factoring can provide them with a quick and easy way to access the cash they need to operate and grow their businesses.

Here are some of the industries that commonly use factoring:

-

Transportation and Logistics

-

Agriculture and Produce (PACA)

-

Oilfield Services

-

Staffing

-

Manufacturing

-

Cable and Telecom

-

Landscaping

-

Commercial Cleaning

-

Contractors

-

Wholesale

-

Food and Beverage

-

HVAC

The Best Invoice Factoring Companies

When looking for the best factoring company, consider the following factors:

Industry Expertise: The best factoring company will be familiar with your industry’s specific needs and challenges.

Customer Service: Opt for a company that provides excellent customer support and maintains clear communication.

Invoice Minimums: Many factoring companies charge a fee if you don’t factor enough invoices each month, so look for a company with no minimum requirements.

Additional Services: Choose a factor offering collection support, credit checks, and online portals.

Fee Structure: Understand the fee structure. It should be transparent with no hidden charges.

Advance rates: Higher advance rates mean more upfront cash, but lower net proceeds.

Flexibility: Select a factoring company that offers tailored solutions to meet your unique business requirements.

Invoice Factoring with Quickpay Funding

We’re not just your ordinary factoring company. At Quickpay Funding, we find ways to say “YES” to our clients and provide unique services to ensure they get the money they need, when they need it.

24/7 Same-Day Funding

We fund all of our clients’ invoices the same day they are submitted. This includes nights, weekends, and even on bank holidays.

Back-Office Support

We provide an array of administrative support such as bond filing, carrier packet completion, collection efforts on unpaid invoices, credit checks, and much more.

No Cutoff Times

There are no cutoff times when you fund with Real-Time Payments. When we say we’re open to fund our clients 24/7, we really mean it.

No Invoice Minimums

Unlike other factoring companies, we don’t charge minimums. We have no monthly minimums, no minimum invoice amount or volume minimums.

Online Management Tools

With the Quickpay Portal you can easily upload your invoices and manage your factoring account online.

Apply for Invoice Factoring Today!

Our application takes approximately 5 minutes to complete once registered.